BTC Price Prediction: Navigating the Current Correction - Is BTC a Good Investment?

#BTC

- Bitcoin is trading below key technical levels but showing early signs of momentum shift with positive MACD histogram

- Mixed fundamental landscape with bearish news about wallet vulnerabilities offset by institutional accumulation signals

- Current correction may present buying opportunity for long-term investors despite short-term uncertainty

BTC Price Prediction

Technical Analysis: Bitcoin Trading Below Key Moving Average

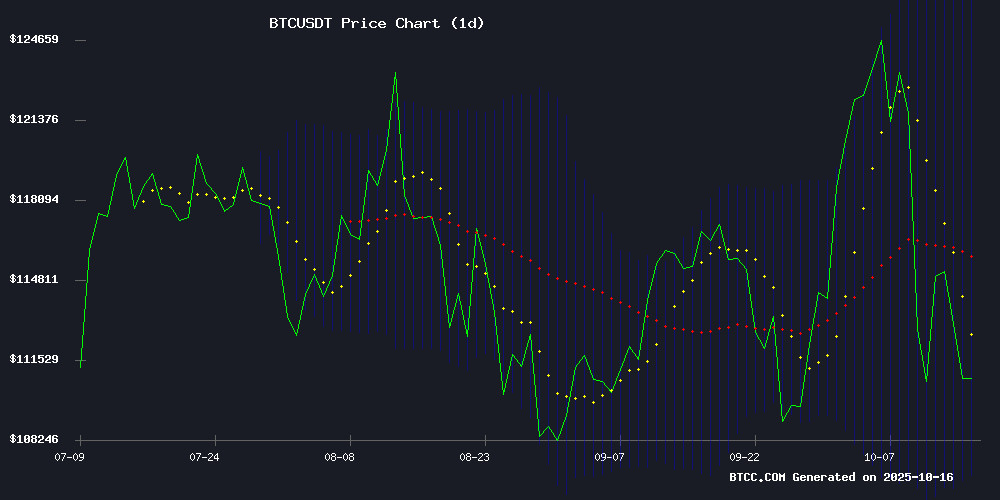

According to BTCC financial analyst Robert, Bitcoin is currently trading at $107,966, below the 20-day moving average of $116,683, indicating short-term bearish pressure. The MACD shows negative values at -540.07 for the MACD line and -2583.56 for the signal line, though the positive histogram of 2043.49 suggests potential momentum shift. Bitcoin is trading near the lower Bollinger Band at $106,234, which may act as support. Robert notes that a break below this level could signal further downside toward $100,000.

Market Sentiment: Mixed Signals Amid Correction Phase

BTCC financial analyst Robert observes that current market sentiment reflects a correction phase with several bearish catalysts. The revelation of a critical bitcoin wallet vulnerability affecting 220,000 addresses has created uncertainty, while Binance-led selling pressure contributes to short-term weakness. However, Robert highlights positive counterpoints including significant Bitcoin outflows from exchanges suggesting accumulation, and Ark Invest ETF data indicating institutional interest. The emergence of new mining capacity through Bitdeer's expansion provides fundamental support despite the technical correction.

Factors Influencing BTC's Price

MicroStrategy Stock Dips as Bitcoin Slumps Below $110K, Investors Eye Metals

MicroStrategy (MSTR) shares fell in tandem with Bitcoin's decline below $110,000, underscoring the company's tight correlation with the cryptocurrency. The business intelligence firm, which holds over $74 billion in BTC, has seen its stock swing from $123 in August 2020 to $284 today—peaking above $1,300 during Bitcoin's 2021 rally. An 85% annualized return, including Leveraged Bitcoin exposure, highlights its aggressive crypto bet.

The US Treasury's recent waiver of a multi-billion dollar tax liability on MicroStrategy's BTC holdings provided temporary relief, boosting its market cap by $8 billion earlier this month. Yet, the current downturn has investors pivoting to precious metals. Gold and silver futures hit record highs, with silver's undervaluation relative to gold signaling further upside. "Silver likely has higher to go," said John Hathaway of Sprott Asset Management.

S&P 500 Slips Below 125-Day MA as Investors Eye Crypto and Precious Metals

The S&P 500's slide below its 125-day moving average has intensified concerns about US equities, with the index down 1.4% this week. Trade tensions and the prolonged government shutdown continue to weigh on market sentiment, driving some capital toward alternative assets.

Cryptocurrencies and precious metals are benefiting from the risk-off mood. Bitcoin recently hit a record high of $124,000 before settling at $108,000, while gold and silver prices show sustained upward momentum. The shift underscores growing diversification strategies amid equity market uncertainty.

Wall Street remains cautiously optimistic about stocks, citing strong corporate earnings and anticipated Fed policy support. Yet the simultaneous strength in crypto markets suggests investors are increasingly hedging traditional market risks through digital assets.

Binance-Led Selling Pressures Bitcoin Amid Short-Term Correction

Bitcoin fell 2% in the past 24 hours, dipping below $111,000 as Binance-driven selling overwhelmed U.S. demand. CryptoQuant attributes the decline to platform-specific futures activity rather than a structural market shift.

Three metrics tell the story: Coinbase Premium remains positive, reflecting strong U.S. institutional buying, while Binance's negative funding rate and tumbling Taker Buy/Sell Ratio reveal concentrated short-selling. The exchange's influence appears disproportionate—futures traders there have maintained bearish positions for four consecutive days even as other platforms turn bullish.

On-chain fundamentals suggest this is a cyclical pullback, not a trend reversal. Network activity and long-term holder accumulation continue to signal underlying strength. Market veterans watch for 'Uptober' seasonal trends to counterbalance the current technical pressure.

US Government Reveals Critical Bitcoin Wallet Vulnerability Affecting 220,000 Addresses

The U.S. government's seizure of $15 billion in bitcoin from a 2020 heist has exposed a critical vulnerability in certain wallet addresses. A flawed Pseudo Random Number Generator used to create private keys has rendered approximately 220,000 Bitcoin wallets fundamentally insecure.

Analysts suggest law enforcement may have known about this vulnerability for years, choosing to disclose it only during criminal proceedings. The revelation now puts affected holders at risk, as malicious actors could exploit the weakness to drain vulnerable wallets.

Security experts urge Bitcoin holders to verify their wallet status immediately. The disclosure raises broader questions about cryptographic standards and the ethics of vulnerability disclosure in decentralized systems.

BTC Outflow and Price Flip Soon? 4 Ark Invest Bitcoin ETF Say Yes.

Bitcoin ETF outflows totaling $104 million have unsettled the market, but four new BTC ETF filings by Ark Invest could signal an impending reversal. Investors are bracing for a potential surge as institutional interest mounts.

The filings suggest growing confidence in Bitcoin's long-term value proposition despite recent volatility. Market participants are closely watching for signs of renewed capital inflows.

Bitcoin Faces Resistance Amid Bearish Predictions and Gold Comparison

Bitcoin's price struggles to hold above $115,000, encountering significant resistance as it slips below $108,000. Prominent gold advocate Peter Schiff seized the moment to declare, "Gold is eating Bitcoin’s lunch," citing a 32% decline in Bitcoin's value when priced in gold since August. Schiff warned of a "brutal" bear market and urged investors to abandon "fool’s gold" for tangible assets.

Former Binance CEO Changpeng Zhao countered with sarcasm, pointing to Bitcoin's historical resilience—from $0.004 to $110,000 over 16 years. Despite short-term volatility, the cryptocurrency's long-term trajectory remains a focal point for proponents.

Amid the debate, analysts hint at a potential October rebound for Bitcoin, though skepticism persists about its role as a dollar alternative or "digital gold." The clash between traditional and digital asset ideologies underscores the market's divisive nature.

Bitcoin Mirrors 2024 Reversal Pattern After Filling Weekly CME Gap

Bitcoin has completed a critical technical milestone by filling its weekly CME gap between $109,680 and $111,310, echoing a bullish setup last seen in late 2024. The cryptocurrency now holds the same higher low structure that preceded a two-month rally from $68,785 to $108,000 during that period.

Analysts at RektCapital observe a bullish divergence forming on daily charts, suggesting potential for a breakout toward $130,000 before Q4 concludes. Market sentiment, however, reflects 2017-level pessimism, with traders expressing exhaustion and doubt despite the technical indicators favoring continued upside.

The recent price action follows a brutal wipeout last Friday that left many convinced the cycle has ended. Yet macroeconomic factors and historical patterns contradict this bearish narrative, pointing to possible renewed momentum.

Bitdeer Surges to Fifth Place Among Public Bitcoin Miners with New Sealminer Rigs

Bitdeer has overtaken Riot Platforms to claim the fifth position in hashrate rankings among public Bitcoin miners. The company's deployment of its proprietary Sealminer equipment added 5 EH/s to its mining capacity, driving a 15.5% monthly increase in total hashrate to 35 EH/s.

September saw Bitdeer mine 452 BTC, a 20.5% increase from August's 375 BTC. The miner's realized hashrate jumped from 24.64 EH/s to 32.74 EH/s, reflecting improved operational efficiency. New mining facilities in Norway's Tydal and Bhutan's Jigmeling contributed to the growth.

The company plans to reach 40 EH/s by October's end before phasing out older, less efficient third-party rigs. Bitdeer has already manufactured 34.2 EH/s worth of its Sealminer A2 units, with 22.6 EH/s currently operational.

New Wallets Move Over $160M In Bitcoin From Binance And FalconX – Details

Bitcoin hovers precariously above $110,000 as bulls attempt to fortify support levels following last week's dramatic plunge. The market remains on edge, torn between recovery Optimism and bearish apprehension after one of the year's most volatile trading periods.

On-chain analysts report significant whale movements, with newly created wallets withdrawing substantial BTC holdings from major exchanges. This cold storage migration typically signals accumulation phases or strategic portfolio repositioning among institutional players.

The cryptocurrency's price action shows tentative consolidation, though technical indicators reveal fragile momentum. Sustained recovery WOULD require stronger demand inflows to overcome current selling pressure.

Is BTC a good investment?

Based on current technical and fundamental analysis, Bitcoin presents a mixed investment case according to BTCC financial analyst Robert. While short-term indicators show bearish pressure with price trading below the 20-day MA and negative MACD readings, several factors support long-term investment potential.

| Metric | Current Value | Interpretation |

|---|---|---|

| Price vs 20-day MA | $107,966 vs $116,683 | Short-term bearish |

| Bollinger Band Position | Near lower band ($106,234) | Potential support level |

| MACD Histogram | +2,043.49 | Positive momentum building |

Robert suggests that investors with longer time horizons may find current levels attractive for accumulation, given the strong institutional interest evidenced by ETF flows and ongoing network development. However, short-term traders should exercise caution until technical indicators show clearer reversal signals.